In these case studies I rely, in part, on the content of phone conversations to identify the business names behind the lead generation ads.

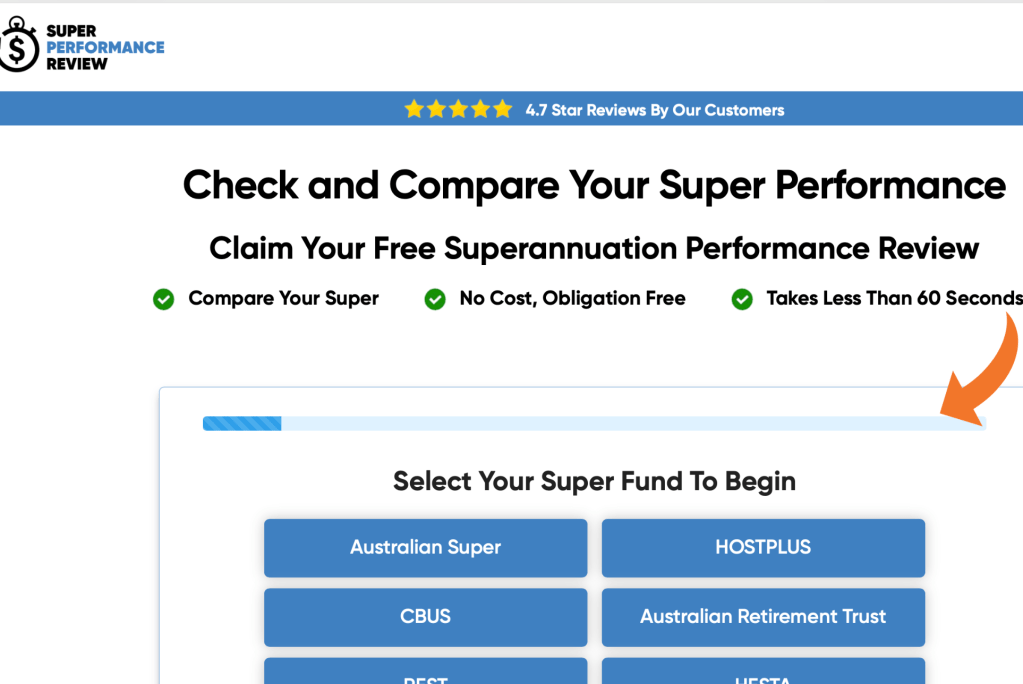

Similar to all these ads, once you click you’re asked to provide basic information about the name of your super fund, how much super you have, your age and contact details.

There is a website for Super Performance Review, and the owner is shown as EMBR. EMBR is a lead generation company based in Templestowe in Victoria.

On entering these details I received a text advising me that I would receive a call from JDX Wealth Group.

I received a call from someone identifying they were from JDX. After confirming my personal details (ie those details that I provided online), I asked “What does JDX do? Do you refer me to a licensed person?”

The response was a little confusing. The caller told me that they compare super funds side by side, looking at the performance over the past 5 years. He said they do a Statement of Advice (although the website says this is done after a financial advisor is involved). I asked again if that is after I speak to a licensed person, and the caller said “we will do a deep dive into how it’s set up”.

JDX Wealth Group’s website says that the process involves a brief chat, in which a 45 minute online consultation is booked. This consultation is not with a licensed advisor, but calculators are used to forecast super balance, and “we educate you on more attractive wholesale options and provide comparative projections”. It is only after this that they refer to an initial meeting with a financial planner.