- ‘Damage waiver” in car hire contracts isn’t insurance, doesn’t cover some types of accidents and can leave drivers exposed to huge bills

- Excess insurance may be of little, or no benefit, if the ‘damage waiver” doesn’t cover you

- While many insurers sell “excess insurance”, I only found one which insured the whole vehicle.

I don’t guarantee the accuracy of this information which is intended to provide general information only and does not constitute legal advice. The information relates to Australia.

When driving a hire car, you are probably driving uninsured – whether or not you pay for excess reduction. (This may not apply to car share schemes which have different arrangements).

Take Susan and Roy. They recently hired a car in New Zealand[1], and made a point of paying for “excess reduction” cover. While driving on a narrow road, Susan briefly lost concentration and the car crossed to the other side of the road and slipped into a ravine.

Luckily, no-one was hurt, but Susan and Roy found that they were liable for the full cost of the car (a write-off) under the car hire agreement because the “collision damage waiver” provided by the car hire company excluded any accident if the driver was charged with “an infringement/offence”. Police attended the accident and Susan was fined for crossing double lines.

They were also held liable for the cost of recovering the vehicle, which was significant. They couldn’t even claim the $4,000 excess cover because the ‘offence’ exclusion applied to that too.

Consumer Action Law Centre had two clients with similar experiences, where exclusions meant that the drivers were liable for very large amounts. These debts can be $50,000 or more (if you include damage to another party) and if you have a low income and few assets you could consider bankruptcy. However, for people with equity in a home, a large debt can put that home at risk, or have a long-term impact on their finances.

‘Collision Damage Waiver’ is not insurance

In Australia, the cover provided by hire car companies is not “insurance” but referred to by terms such as “collision damage waiver” (CDW). While people might think of this as insurance, it is not subject to the consumer protections in the Insurance Contracts Act, not regulated by ASIC, and not subject to dispute resolution by an ombudsman scheme.

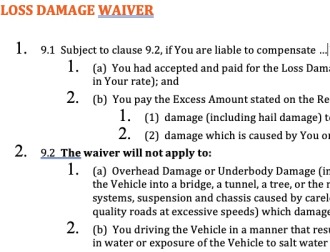

CDW often excludes cover for things such as water damage, tyre damage, overhead damage and recovery costs for a single vehicle accident – things that would usually be covered by the insurance on your own car. If you hire a truck, “overhead damage” may include the entire storage section of the truck.

Also, CDW often doesn’t apply in a range of circumstances such as if you break the law (even accidentally), fail to lock the car or keep the keys secure.

Regardless of how cautious we are, mistakes can be made and we would expect insurance to cover us.

It is because accidents like this happen that we insure our own cars – and we don’t expect to be sent broke if we have an accident in a hire car.

How does this differ from ‘normal’ car insurance?

Your own car insurance policy is unlikely to have these exclusions, and the insurance law is much fairer for consumers. For example, while ordinary car insurance probably won’t pay for damage caused by “reckless acts”, they can’t simply refuse a claim based on negligence (for example driving through water or leaving the car unlocked).

As the Financial Ombudsman[2]has said:

The commercial purpose of car insurance is to cover loss or damage, for among other things, negligence by the driver.

For a ‘reasonable precautions’ exclusion to apply, the [insurer] must demonstrate both that:

- the driver had an actual recognition of the existence of a danger, and

- the driver then courted the danger that they recognised, or was recklessly indifferent to the recognised danger [3].

Finally, with actual insurance, you have access to free dispute resolution through the Ombudsman.

Are hire-car contracts unfair?

In 2013, the Federal Court declared a number of terms in Europcar Australia’s standard rental agreement to be void under unfair contract term laws. The decision found the terms to be unfair because they purported to make the consumer liable irrespective of:

- whether there was fault in relation to the driving of the car, or

- the extent to which any fault by the consumer contributed to the loss.

While this decision may be relevant in cases where a hirer refuses to cover damage due to a breach of the contract by the driver that didn’t contribute to the loss, it is unlikely to help in cases like Susan and Roy’s.

Excess insurance

This is available from hirers or separately from various insurance companies (which is much cheaper). Excess insurance can cover an excess of between $4,000 and $10,000 depending on what you choose, and may cover some things excluded by CDW such as tyre or overhead damage.

However, excess insurance may not help if the particular accident/damage isn’t covered by CDW. If you are liable for the total bill, the insurer may decide there is no “excess”. Even if your excess claim is paid, it would only go a small way to compensate for any significant loss.

So what can you do?

Until recently I thought there was little choice – but I recently found an insurer that provided cover for any car that I hired within the insured period. I paid $13 per day for this insurance from Rental Cover which covered up to $100,0000 and had a $0 excess. Compare this to the hire car company charging over $20 to cover just a $4,000 excess!

Still, there were exclusions:

- Any claim where you have not met the terms of your rental agreement.

- Any claim where a contravention of the local laws has taken place resulting in a court action.

So, these exclusions are somewhat unclear, and I still didn’t have cover as good as my own car insurance, but it was better than relying on the hirer’s expensive, dodgy product or on excess insurance alone. Because it is insurance, a dispute about these exclusions could be taken to the Ombudsman (at no cost) and insurance law would apply, meaning a fairer interpretation of any exclusions.

There may be more than one company providing similar coverage, but I haven’t found one yet.

Surely it’s time for car rental firms to provide genuine insurance, and for the insurance industry to offer better products to those of us who like to drive insured.

Please leave me a comment if you know of any car hirers that provide insurance, or other insurers who provide a similar product.

[1]While New Zealand and Australian laws are different, the outcome of this accident is likely to have been the same in Australia.

[2]Financial Ombudsman Service, now called the Australian Financial Complaints Authority.

[3]https://www.fos.org.au/the-circular-20-home/fos-forum/key-determinations/

Hello Carolyn,

Very interesting (and scary) post, thanks. I am currently looking for an insurance for the campervan that I am going to rent. I do not want to pay the abusive prices requested by the rental company, which also do not protect the most common small accidents. I have found several like: Tripcover , Hiccup, insurance4hire, carhireexcess….This post is very useful for me: https://www.ridehacks.com/ultimate-guide-to-rental-car-insurance/

Greetings

Hi Ramon, glad you found it useful. I think all those you mention just cover the excess – I think Tripcover insures car if you’re driving in the US, but their website is confusing.

Hi agan! I think there are only insurances for franchises, I have never seen insurance for the entire rental car. In fact, I think that rentalcover only covers the franchise. Do you have the link to Rentalcover for the full insurance of the rental car and not just the franchise? Thanks

Here’s a link to the policy wording, where you can link to the Product Disclosure Statement https://www.rentalcover.com/pds/A116-4MMU-INS

Now I understand why I had not found that insurance option: Unfortunately, that insurance is only available for cars. Not for campervan…