You can find updates on this case here.

As the date for hearing approaches, here’s some background about Dominique Grubisa.

On 18th March 2024, the Federal Court (Sydney) will start hearing the ACCC’s case against Dominique Grubisa and Master Wealth Control (trading as DG Institute). Master Wealth Control was owned jointly by Grubisa and her husband Kevin and more recently by a company controlled by Kevin. See ACCC’s statement provided to the Court

The ACCC alleges that Grubisa made misleading representations in relation to Real Estate Rescue program and Master Wealth Control program.

The three specific misrepresentations alleged by the ACCC are:

- if a bank repossesses and sells a home, the homeowner loses all their equity because “banks don’t give change”

- the Vestey Trust was “bulletproof”, “impenetrable” and would result in students being “unable to be effectively pinned down by creditors”

- the Vestey Trust structure had been tested and upheld as effective by the Full Federal Court of Australia in case Sharrment.

These three alleged misrepresentations were made when selling courses and products. Her conduct has also been of concern to other regulators, and it is my opinion that much of the content of the courses and manuals was incorrect or unethical.

- Who is Dominique Grubisa?

- Products and courses

- Dodgy claims

- Legal action and criticism

- Grubisa’s response to regulators and critics

- Grubisa’s boasts

- Who are the victims?

Who is Dominique Grubisa?

According to her Linkedin profile, Grubisa is an “entrepreneur and property educator”, and CEO and founder of the DG Institute (a trading name of MWC). She has promoted a range of expensive courses and programs on wealth, debt management and property since 2009.

Grubisa is a lawyer, although she no longer holds a practising certificate. She was admitted as a lawyer in June 1994, worked for GMAC (probably doing debt collection work), going to the bar two years later. She claims she was “at the top of [her] game” at the bar but had reached a point where she couldn’t earn any more. It’s also quite possible that her career at the bar wasn’t progressing, and she saw no future there.

A key selling point for Grubisa is a story about “losing it all” in the GFC in 2008, although this can’t be verified. She claims she and her husband went from having 15 properties, to being tens of millions of dollars in debt. According to one of many “news” stories, they subsequently “sold some properties, held onto others and put tenants into several others and in 2010, the family moved into one of the properties they had managed to keep.” None of this has been independently verified.

By June 2009 (6 months after she reported being “homeless” due to her financial problems) Grubisa was on TV, promoting herself as the “debt busting barrister”.

Grubisa started on the path of self-promotion, publishing a book about managing debt and another about divorce in 2010. She was on stage with Rick Otton and others at a property investment conference in 2012. In 2015 Grubisa established a business with her husband, the “Australian Investments and Migration Service” to “allow foreign investors to purchase “unlimited properties within the Australian market”, apparently to avoid foreign investment rules.

While Grubisa had been spruiking her property courses for some years, her ‘no money down’ property strategy probably really took off around 2017.

Grubisa’s Linkedin shows she obtained a Masters of Laws in 1996, and her website claimed “She is also one of the small number of legal practitioners in Australia to have obtained a Master of Laws degree with a specialisation in debt law”. I haven’t been able to find out what she means by “debt law” (credit law? Insolvency law? Debt recovery?), however she later claimed in an interview that at the time she lost everything (12 years after she did her Masters) she had no knowledge about debt. She said “I was full on into property law, …I had no knowledge around debt, except for basic knowledge of where to look in statutes and where to focus on what your rights were.”

Products and courses

Products and courses sold by Grubisa and related companies include:

- Real Estate Rescue – “no money down” – “helping” (or exploiting) homeowners by taking a power of attorney to take control of (and ultimately sell) the house.

- Master Wealth Control (‘Vestey Trust’) – claimed to protect your assets by establishing a ‘friendly’ trust that lodges a caveat on your home and other property.

- Business Turnaround – how to identify, and take control, of struggling businesses with ‘no money down’

- Debt Management Program – negotiating on your behalf with creditors

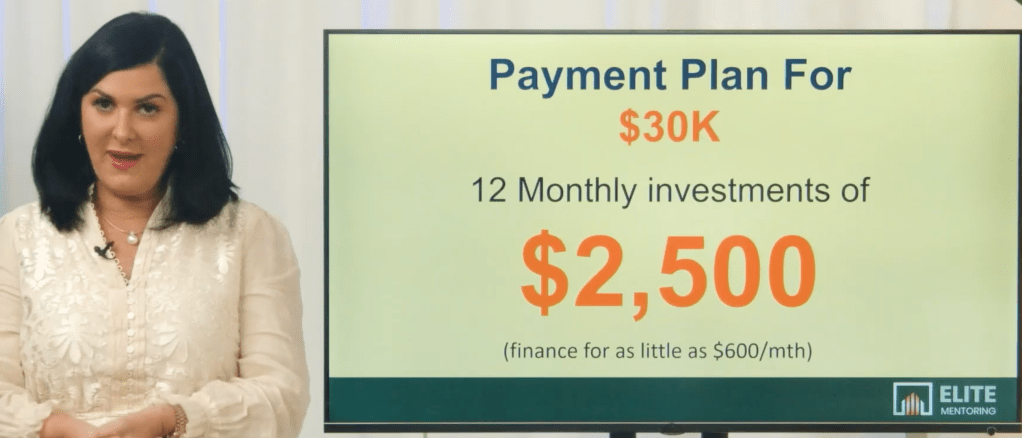

- Elite mentoring

Prices for courses range from $5,500 – $10,200 and mentoring programs up to $50,000.

Dodgy claims

Grubisa’s seminars and manuals included information that was wrong, and in some cases dangerous for students who try to implement her strategies. Just a few examples:

Claims that she held licences which she didn’t hold, including claiming she was an “ASIC licensed debt specialist”. See Grubisa & ASIC [2023] AATA 3328 (10 October 2023)

Dangerous advice about taking over a failing business including “You need to assume control if the business’ economic woes are to be arrested. Don’t cede control to the owner”…..”You can reverse engineer your involvement in the business to lower the risk of being seen as a shadow director” and “You technically don’t know you are trading insolvent unless you are advised of such by a lawyer or accountant…. Asking for professional advice is putting your own neck on the line.” (From Business Takeover Manual).

At a 2015 seminar, Grubisa supported a couple profiting from equity from a deceased’s property, and taking steps to ensure that only one of the deceased’s daughters was aware of the transaction. Despite advice from a solicitor who Grubisa referred the students to advising then “don’t touch it”, Grubisa says “it’s a massive risk but let’s look at the numbers and see why it’s a risk worth taking”.

Telling students to mislead AFCA – Grubisa’s material says if the bank won’t provide information to the ‘student’ “Go to AFCA, say you are a friend wanting to help, and ask how much is owed on the loan so you can bail them out and make payments for them to come to some arrangement”.

Telling students to mislead banks – “A lender will not accept a short sale proposal where the borrower is getting paid some cash so ensure that this is not a term of the contract. Any cash or benefit to the owner must be on the side.” As the AAT Deputy President noted “The concept of undisclosed side payments passing between the would-be investor and the seller was referred to throughout the manual…”. “although Ms Grubisa was slow to see any issue when asked about it”. See Grubisa & ASIC.

“Banks don’t give change” – While additional fees are added if a bank (or other mortgagee) sells a property, these must be reasonable, and the bank can’t just keep the equity. In one example where the owner had $200,000 equity, Grubisa says “The way the system works is that the bank would normally take everything – they don’t give change – they take all the equity plus the $295,000 that they were owed. The way we do it is far more equitable.” The danger here is that students tell vulnerable owners that they won’t get anything if the bank sells, therefore making the owner more likely to accept the deal offered by the student. Needless to say her statement is legal nonsense and grossly misleading.

Bulletproof Vestey Trust – I’ve written before about the problematic claims that Grubisa makes about her “Master Wealth Control” “Vestey Trust” being “bulletproof”, “impenetrable” , providing protection from creditors, and her claim that the Vestey Trust structure had been tested and upheld as effective by the Full Federal Court of Australia in case Sharrment. https://thenaysayer.net/2020/04/22/dominique-grubisa-master-wealth-control-vestey-trust/

Grubisa used some irresponsible and frightening claims to sell the “Vestey Trust” during COVID:

- “Those who do not act quickly risk having their wealth destroyed or taken. EU and US govts are already looking at superannuation funds as a massive pool of money…..” Dominique Grubisa (2019)

- “..if banks collapse then instead of the government bailing them out it will be …. their customers….that is a sleeping giant in Australia right now.” “Govt [may] decide to pirate super benefits in the future”

- “Notwithstanding the legislative protections that currently exist, should the Government decide to pirate superannuation benefits in the future….”

Legal action and criticism

ASIC Ban – ASIC bans Grubisa from providing financial services, stating that Grubisa “Has habit of not telling the truth”. Grubisa won her appeal on the basis that she had no plan to provide financial services, but the AAT Deputy President didn’t disagree with any of ASIC’s claims about Grubisa’s conduct.

The AAT Deputy President made “serious adverse findings”, finding that one of her strategies “appears to rely on misleading or deceptive conduct” and that the ASIC’s “fit and proper person” ground had been made out. AAT said “The lack of attention to the underlying rules which are supposed to regulate her conduct tends to reinforce the adverse conclusion I have already reached from the other evidence about her fitness”. See Grubisa & ASIC.

Restrictions on data use – CoreLogic refused to allow MWC to continue to access its property data, and Archistar also restricted her access, referring to “predatory” use of property data. MWC sued CoreLogic, and that case is still progressing. (2022)

Possible director breaches –The liquidator for collapsed companies linked to Grubisa reports that it believes the businesses may have traded while insolvent. (Sep 22)

No licence to practice law – The Victorian regulator for lawyers announced that Grubisa “no longer holds a practising certificate in Victoria” and is “not entitled to engage in legal practice anywhere in Australia”. While Grubisa told her followers that it was her decision to withdraw her application for a practising certificate because she didn’t need it, it appears that she did this as a result of a letter from the VLSB saying the VLSB had a number of concerns about Ms Grubisa’s conduct and was considering whether to refuse her application for renewal of her practising certificate on the basis she was not a fit and proper person. (June 2022). More details here.

ATO warning – ATO issues warning about Vestey Trust, and claims (made by Grubisa) that the trust would protect an SMSF from creditors, stating that this may breach superannuation laws. (Dec 2022)

Misleading conduct proceedings – ACCC issues in Federal Court against Grubisa and her company alleging misleading and deceptive conduct re Real Estate Rescue and Master Wealth Control programs. (Dec 2022). Hearing set down for March 2024.

Law Society proceedings – The NSW Law Society filed an application seeking a disciplinary finding that she is guilty of professional misconduct as defined in the Legal Profession Uniform Law (NSW)(Uniform Law). Grounds included that she “ acted in circumstances involving a conflict of interest, represented that MWC was entitled to engage in legal practice when it was an unqualified entity, failed to provide legal services competently, made misleading submissions to the Law Society in relation to its investigations, and was involved in the creation of false documents and the provision of false information to a fellow solicitor.” (May 2023). In early 2024, Grubisa was unsuccessful in her attempt to have these proceedings adjourmed until after the ACCC matter was determined.

Grubisa’s response to regulators and critics

Grubisa shares inspirational quotes (often misquotes) about self-belief, such as “failure isn’t fatal”, “kites rise against the wind” and “success is not final, failure is not fatal, it is the courage to continue that counts”. These platitudes can be a useful reminder that we shouldn’t just give up – but can also persuade some people to accept Grubisa’s claims without question, and to continue to implement strategies that either don’t work or are unethical.

Grubisa continues brush aside all criticism and legal action by explaining to her followers that she is vilified for challenging the status quo.

- “It’s far more difficult to walk the road less travelled.”

- “Those full of fear (and ignorance of the law) have chosen to deride and ridicule me.”

- “Those with vested interests and something to lose are threatening me.”

- “Others are seeking to bad mouth me and ruin my reputation”.

Grubisa’s boasts

Grubisa’s is skilful at marketing herself. Her ‘riches to rags to riches’ story is part of every presentation, and it helps to support her key messages:

- she didn’t know how to protect her assets, but she can now show you how,

- she knows what it’s like to be at “rock bottom”. She says “I’ve been there” (at one point talks about being alone in a youth hostel with just a Kit-Kat to eat),

- she discovered strategies along the way and only she knows how you can make money and protect your assets.

Grubisa boasts about her success as a lawyer, and the unique legal expertise that allows her to share “secrets” with her students. She says:

- “..I clawed my way to the top of my game [as a barrister]”

- “I’ve got a whole lot of knowledge in my head. Hundreds of years of case law, statute law.”

- “I’ve got those licenses that banks have so I know all the judiciary, the legislature, the lawmakers what’s happening – insider knowledge there.”

- “Because of the work I do and the various licenses I hold, I’ve got a behind the scenes entrée, first into the judiciary and the legislature.”

- “I shone a light on a very narrow but deep area of law [“debt law”] no-one with my level of legal knowledge had ever looked at before.”

Who are the victims?

While the initial people who were allegedy misled by the “banks don’t give change” representation were Grubisa’s students, the real harm of this representation is that her students used this to convince vulnerable homeowners to give over control of the property, and considerable equity, to the student.

The RER strategies in particular, substantially relied on students finding vulnerable home owners, convincing them that the student could help, and profiting from the property. Owners were required to sign a range of documents including blank land transfer documents and an irrevocable power of attorney. See here for more on RER.

If representations made about the “Vestey Trust” are misleading (and I believe they are), people who have paid up to $10,000 have wasted that money (some entered finance arrangements to pay for the fee) , and may have structured their financial affairs in a way that could leave to further losses.

There is also a broader impact when someone like Grubisa, a qualified lawyer, appeals to “comparatively unsophisticated individuals with limited experience in investment”, provides misleading information, encourages unethical conduct, and shows contempt for regulators and the legal profession.